Taxes You Need to Know About When Living in Colombia

1. Real estate tax (impuesto predial unificado)

Real estate tax is paid by deduction (withholding) from rental income and is part of individual income for taxation purposes.

The (property) tax is imposed on the cadastral value of the real estate as appraised by the municipalities. The rates of the combined property tax on the aggregate value of the land and buildings are between 0.30% and 3.30%.

2. Income tax (Impuesto a la Renta y Complementarios)

While residents of Colombia are taxed on income generated both in and outside of the country, non-residents are only liable for paying taxes on Colombia-sourced income. A non-resident is one who spends no more than 183 days in the country during a tax year (año fiscal), which coincides with the calendar year and ends on 31st December. On the other hand, those who spend longer than 183 days in Colombia during the tax year are considered residents. Married couples are assessed and taxed separately on their earnings.

The first COP$1,090 you earn is tax-free. Personal income tax rates in Colombia go from 10% up to 35% depending on the level of income you are on. Nonresident taxpayers for fiscal matters only have to pay the full current tax rate (35% as of 2017).

Expats living in Colombia should also be aware of double taxation. It is advisable that you check your tax obligations in your home country, as you may be required to pay taxes there along with Colombia taxes. Colombia has some tax treaties in place to avoid double taxation, but they are exclusive agreements with other South American countries. This means expats originating elsewhere may have to pay tax in two countries. Hire a financial advisor would be helpful in avoiding this problem.

If you are a non-resident and you spend less than six months a year in Colombia, you are only required to pay tax on the income generated in Colombia. Residents who have stayed for six months or longer are taxed on all income earned from all sources, no matter where it is. This also includes holiday pay, commissions, bonuses, and other work-related benefits.

3. Rental income tax

Income generated from leasing real estate is considered as ordinary income and taxed at the rate of 33%. Rental income is subject to a tax withholding of 3.5%, which is viewed as advance tax payment. This tax can be credited against the taxpayer's income tax liability when his/her tax return is filed.

Taxable rental income is calculated by deducting income-generating expenses (for instance insurance, taxes, realtor or leasing agent fees, administrative expenses, maintenance, and repairs) from the gross rent.

4. Capital gain taxes (impuesto a las ganancias)

Capital gains from selling real property held for a minimum of two years are subject to capital gains tax at a flat rate of 10%. The taxable capital gains are calculated by deducting the following from the sales price: costs of ownership transfer, acquisition costs (as revalued by the consumer price index), and improvement costs. For nonresidents, the income tax's flat rate is 33% for capital gains from real estate sold within 2 years of obtainment.

Capital gains also arise on inheritances and sales of assets if the recipient is not already liable for keeping accounting records and would be taxed at the standard income tax rate. However, there are exceptional cases which are not subject to taxation, including life insurance policies and royalties for copyrights.

5. VAT

The standard VAT rate (Impuesto al Valor Agregado – IVA) is at 16% and is applied to most imported goods in the country. However, this depends on the purchased item. There are higher VAT rates which apply to goods which are considered luxury items.

6. Industry and Commerce Tax

This tax applies to all commercial, industrial, or service activities performed in Colombia's jurisdiction or municipality through a real estate property. The general applicable tax rates range from 0.2% to 1%, depending on the municipality and category of the activity. In Santa Fe de Bogotá, industry and commerce tax rates are between 0.414% to 1.38%. For income tax purposes, this can be deducted.

7. Wealth tax (impuesto al patrimonio)

Individuals (both tax residents and non-tax residents of Colombia) whose incomes exceed COP $1billion at January 1st of each year are subject to the wealth tax.

Tax residents will have to include assets owned in Colombia and overseas. On the other hand, non-tax residents will be liable for only tax upon assets owned in Colombia (either directly or through a permanent establishment), and expats who have resided in Colombia for less than 5 years can exclude their wealth owned outside of Colombia.

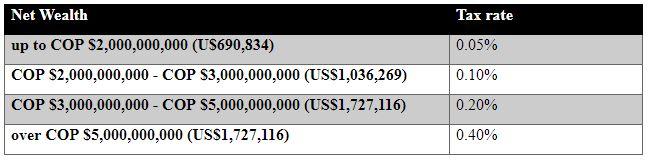

As of 2017, wealth tax is imposed at a flat rate of 0.05% for net worth up to COP $2billion (U$690,834), and it is imposed at a flat rate of 0.10% for net worth from COP $2billion to COP $3billion (US$1,036,269). Net wealth from COP $3billion up to COP $5billion (US$1,727,116) is taxed at the rate of 0.20%, while that of over COP $5billion (US$1,727,116) is taxed at 0.40% rate.

Who is exempt from paying taxes?

Low-income workers are usually not subject to some income taxes, including social security benefits, death benefits, school fees, health insurance costs, and redundancy payments. Not only Colombia nationals, foreigners can also be subject to these tax deductions. Note that there are no additional allowances for those who have children.

Final note

It is advisable to ensure that your tax documents are filed prior to the deadline to avoid penalties. The deadline usually falls in April or May time. The penalty for late tax filings is around 5% for every month of delay up to 100% of the tax or withholding tax due date. It can then be increased from 10% up to 200%. Also, there is an additional interest rate of 10% of the penalty which you must pay. Thus, it is highly recommended that you sort out your taxes before the due date.